Upcoming Webinar on Investments in UK Warehousing | 18th September at 11:00 AM BST | Register Now

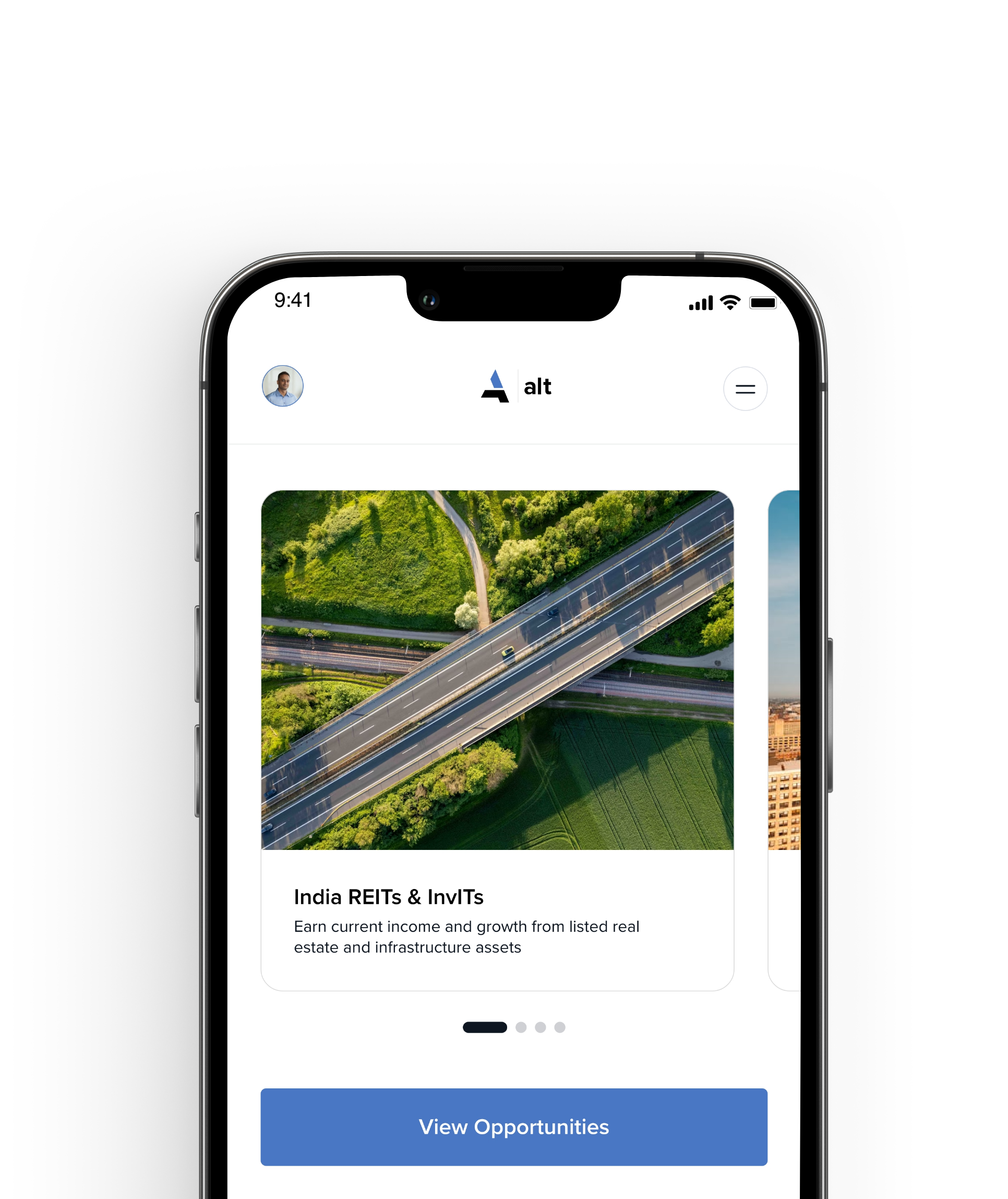

Click on “Opportunities” to view all available investments

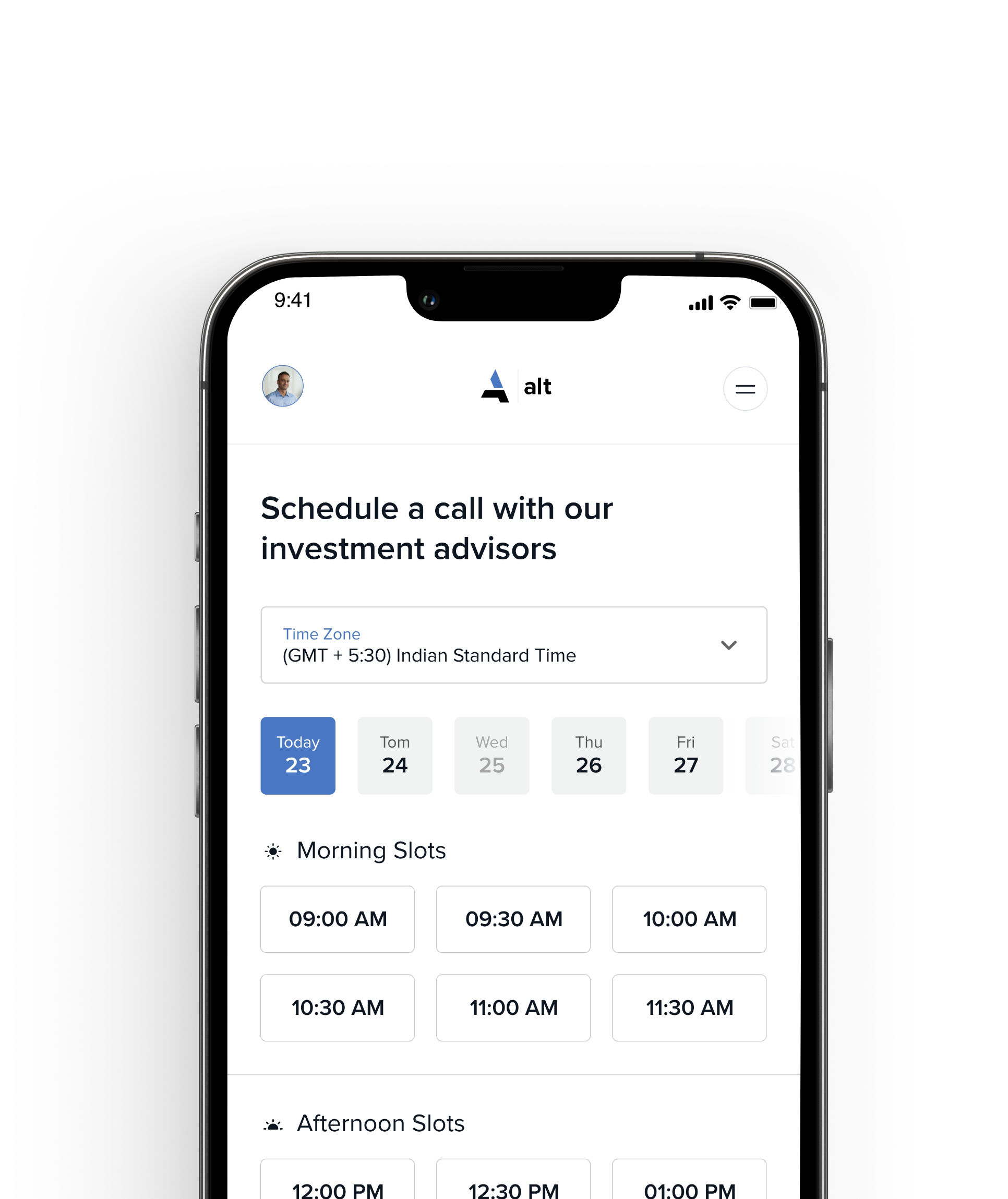

Review detailed investment thesis and schedule a call with our advisor

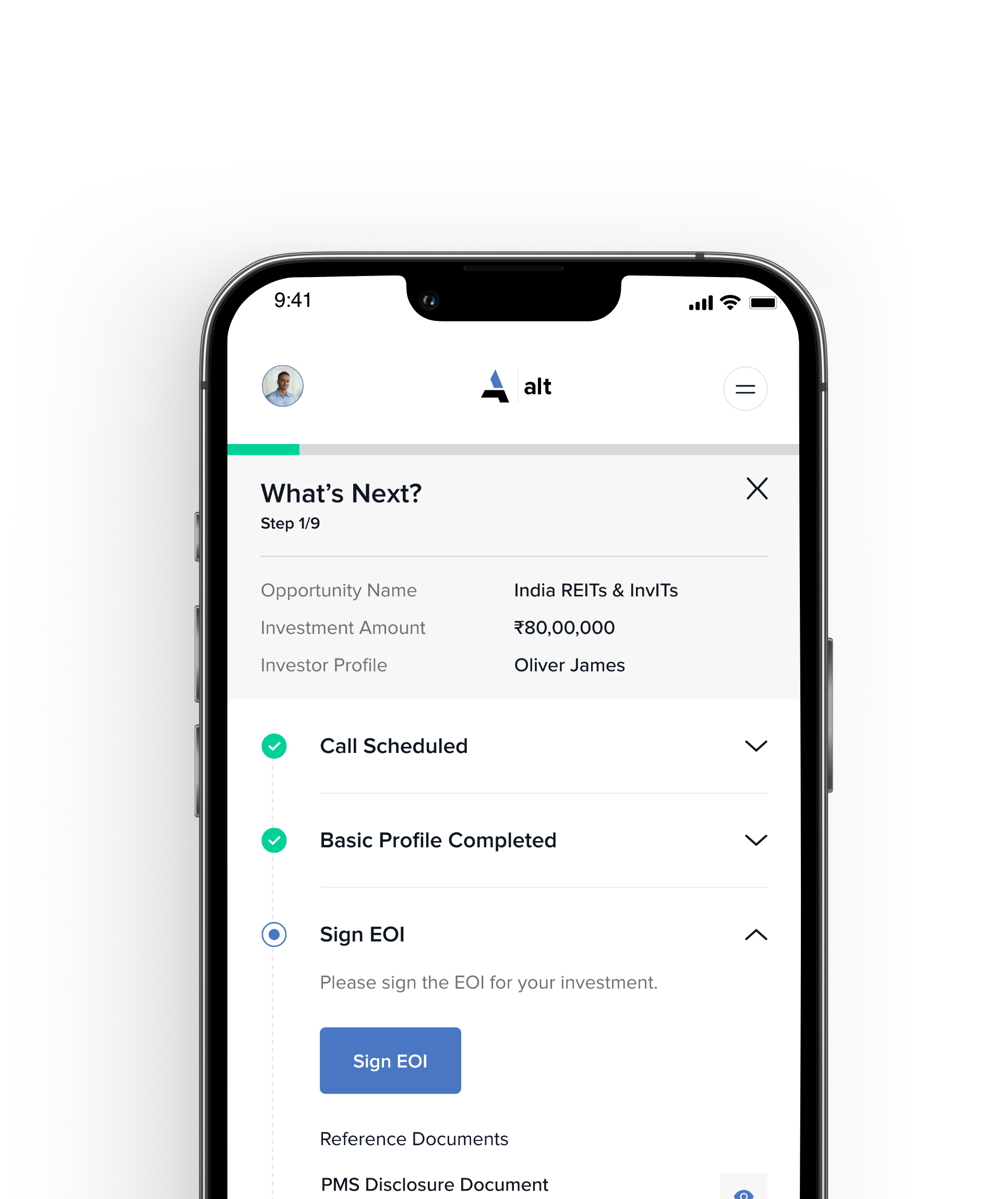

Confirm your investment through our fully digital “What’s next” process

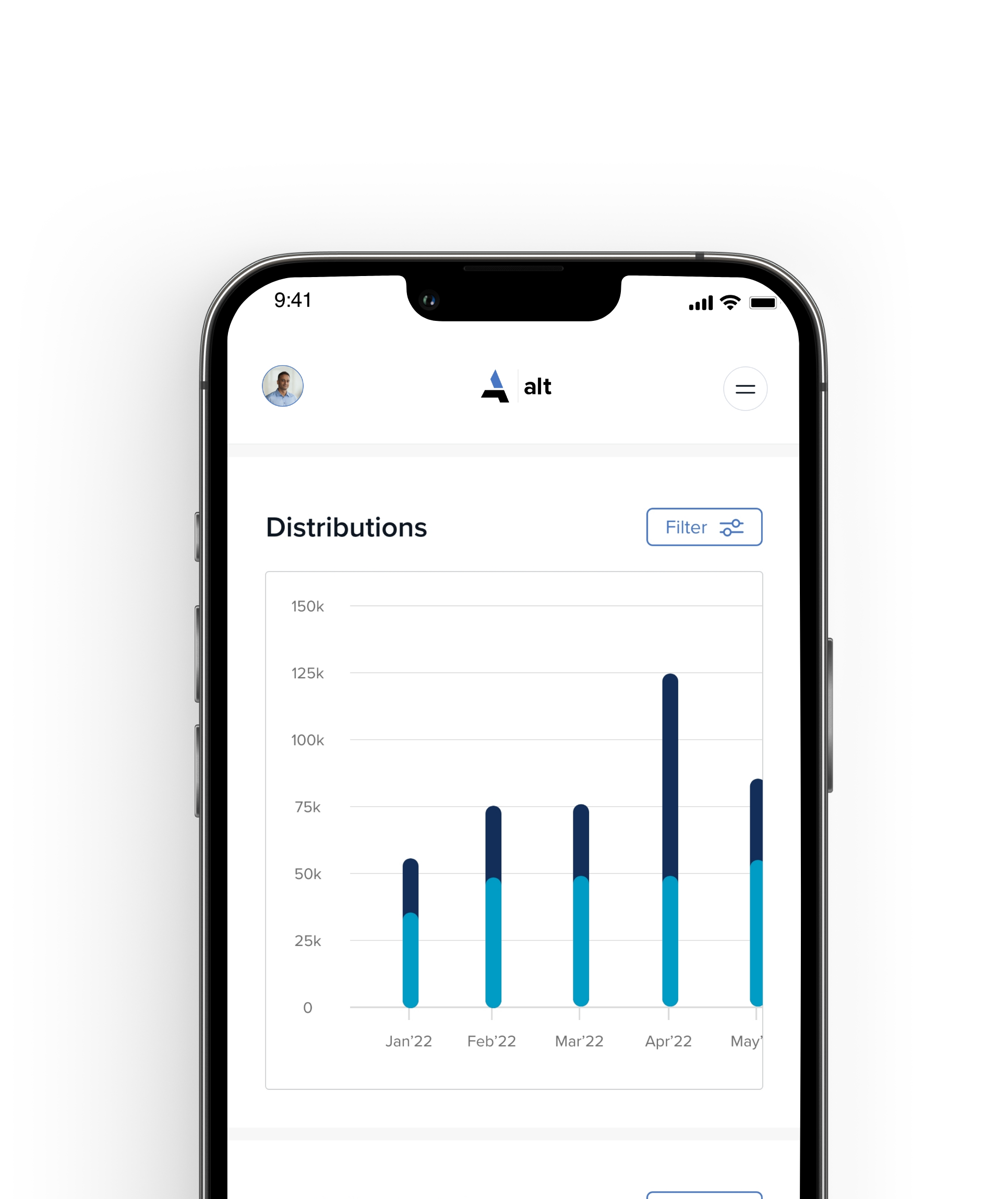

Start receiving monthly/quarterly distributions directly into your bank account

Exit prematurely through our secondary platform or hold till maturity

Note: Represents capital returned to investors in ₹ cr pre-TDS per calendar year.

A 10-year track record of returning capital by the group

The Alt senior team comes with strong institutional experience across assets and markets.

Kunal has over 17 years experience in investing real estate of which 8 was with The Blackstone Group. He has an MBA from IIM Ahmedabad

InvestingExperience

$3 billion

Hashim has over 15 years experience in implementing technology and processes. He holds a B.Tech from IIT Kanpur and an MBA from IIM Ahemdabad.

Years Of Experience

62 years

Ganesh has 11 years of PAN-India real estate investing experience, having led investments for Kotak, SBI RE Fund, and Piramal Capital. Ganesh is a qualified Chartered Accountant.

Mayuresh has over 18 years of experience in real estate credit and asset management, including 8+ years with Altico Capital (owned by Ares Management). He holds an MBA from IIM Ahmedabad.

Rahul has worked across Noble House ($350M family office in Dubai), Deutsche and Standard Chartered Banks. He holds a B.Tech from IIT Bombay and an MBA from IIM Lucknow.

Paulson has over 12 years of expertise in Real Estate Asset Management & Strategy. He has an MBA from IIM Lucknow and a B.Tech. from IIT Delhi.

No. OfInvestments

40+

C.B. Bhave is the former chairman of SEBI and NSDL. He is a 1975 batch IAS officer.

CB Bhave

Advisor

Our board comprises leaders with rich cross-border asset management, real estate and investment experience

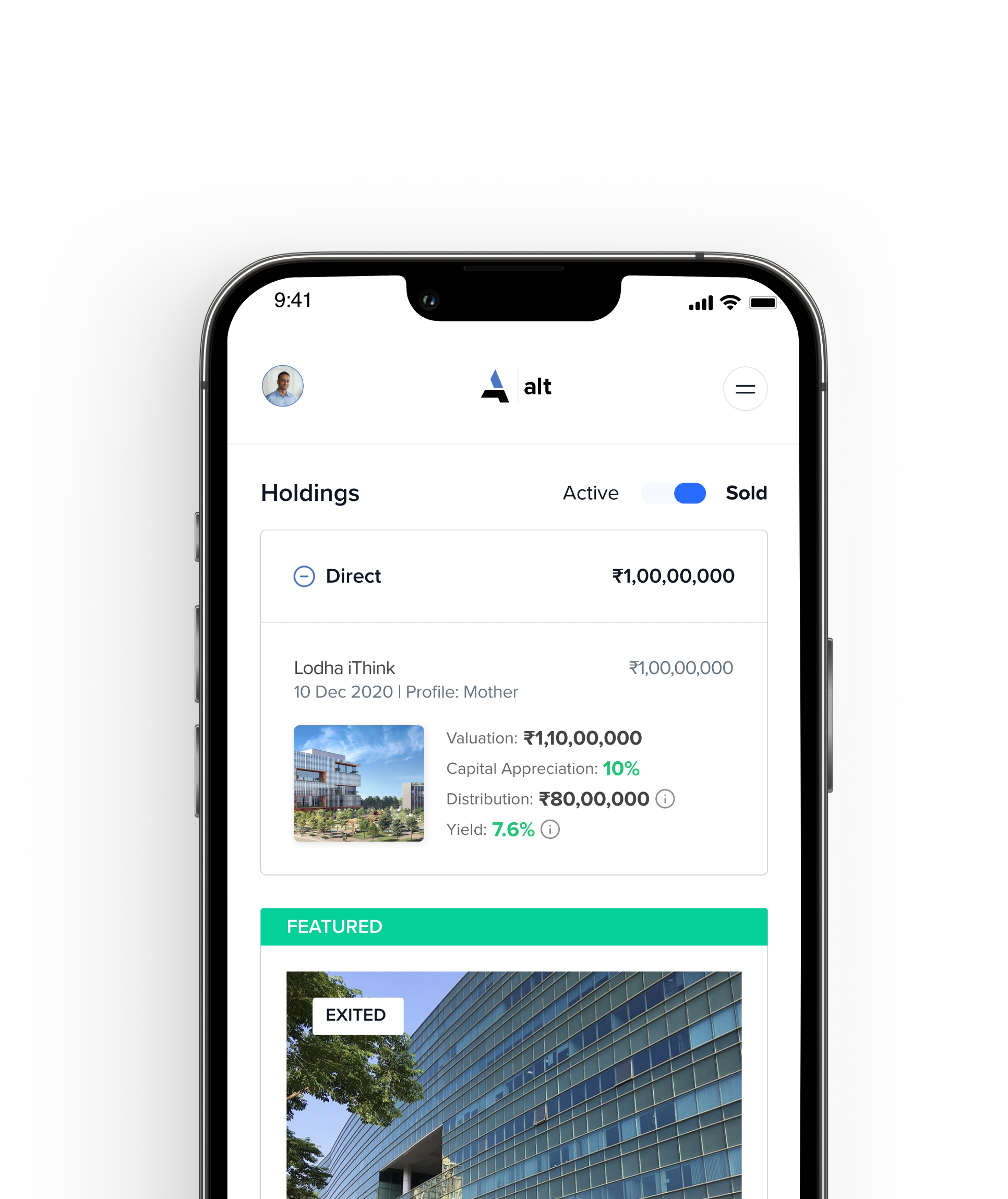

Alt currently offers the following products:

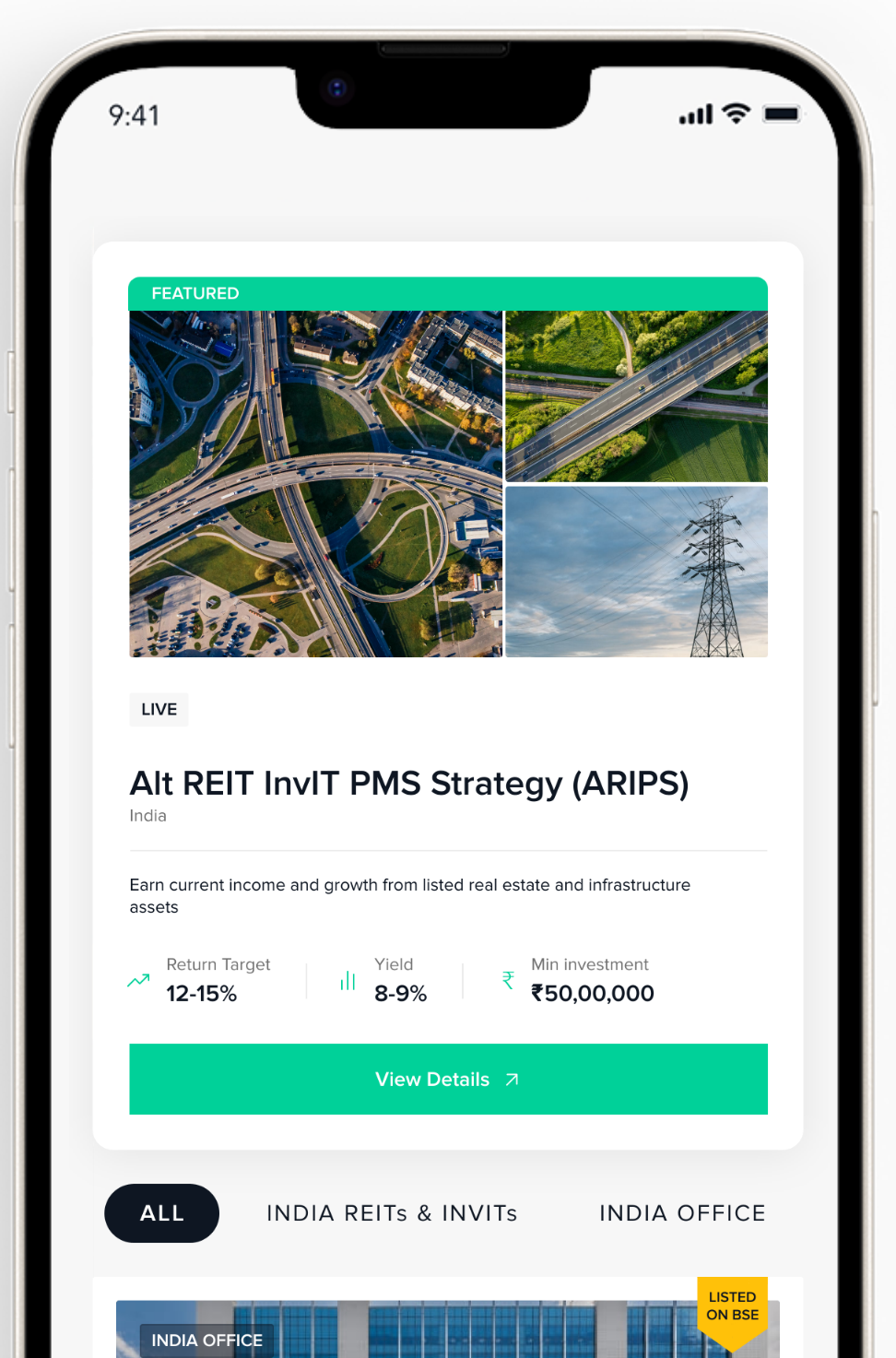

Alt REIT INVIT PMS (ARIPs) - a PMS investing in a portfolio of listed REITs and InVits

Alt Yield Cap Fund II (AYF II) - a Cat II AIF investing in rent-yielding office and warehouse assets

Small & Medium REITs (SM REITs) - direct deal-by-deal investing into commercial real estate

Global REIT fund - an advisory product investing in listed REITs in the US, UK, Europe and Canada

UK warehousing (Alt UK) - direct deal-by-deal investing in leased UK warehouses

Private credit - direct deal-by-deal investing into private corporate and real estate debt

The platform typically charges two types of fees across products:

Asset management fee: An asset management fee is charged on the capital invested

Performance fee: A performance fee is charged at the time of exit on profits above a certain IRR threshold (except for SM REITs)

Prior to joining PropShare, Ben worked first as an Analyst with Deutsche Bank before spending 3 years investing for Noble House Investments, a $ 350 mn single family office based out of Dubai. Most recently he was an Associate Director with Standard Chartered Bank. Rahul holds a B. Tech in Electrical Engineering from the Indian Institute of Technology, Mumbai and an MBA from the Indian Institute of Management, Lucknow.

Prior to joining PropShare, Ben worked first as an Analyst with Deutsche Bank before spending 3 years investing for Noble House Investments, a $ 350 mn single family office based out of Dubai. Most recently he was an Associate Director with Standard Chartered Bank. Rahul holds a B. Tech in Electrical Engineering from the Indian Institute of Technology, Mumbai and an MBA from the Indian Institute of Management, Lucknow.

Former Chairman, SEBI

C.B. Bhave served as Chairman of the Securities and Exchange Board of India (SEBI) for a period of three years starting February 2008. He has also been the Chairman and Managing Director of the then newly created National Securities Depository Limited (NSDL). He is an electrical engineer from Jabalpur Engineering College and 1975 batch IAS officer.

Vikaash Khdloya was the CEO of India's first and Asia's largest office REIT by size, the Embassy Office Parks REIT. Prior to heading the Embassy REIT, Vikaash was MD at Blackstone India’s real estate office prior to which he was VP at Piramal Capital. Vikaash’s accolades also include being member of the Economic Times 40 Under 40 list, CNBC 40 Under 40 list, being a Global Young Presidents’ Organisation (YPO) member, an alumnus of Harvard Business School, a CA gold medallist and a CFA charter holder.

Mamoru Taniya is Chairman of Asuka Holdings Inc. He joined Salomon Brothers in 1987, becoming the youngest Managing Director for the regional trading division of Asia. He founded Asuka Asset Management, one of Japan’s first independent hedge funds, and the private equity fund Mercuria with DBJ. He also serves as Investment Committee member of East Ventures, Partner at D4V with IDEO, and Partner at Evolution in the U.S. He received his Bachelor of Arts degree in law from the University of Tokyo.

Felix Kuna is the MD at K3 Capital, a German family office. Prior to this Felix was the Co-founder of Myo, a German communication platform for the care sector. Felix has worked across real estate sectors in Blackstone and Myo ranging from office, retail, warehousing and more recently the European care home sector. He holds an MBA from IESE Business School, Barcelona.

Enter your mobile number to continue

Please enter your email and we’ll send you a link to reset your password

Email and password login will soon be discontinued. You’ll need to login using your mobile number and OTP. Please update your mobile number in your account settings to ensure uninterrupted access.

Thank you for registering for our upcoming webinar on

We will send you a confirmation email with all the key details.

You have already registered for this webinar. We will again initiate a confirmation email with all the key details to your email address.