1:1 with an Alt advisor

Why should investors choose Alt?

New Age Investments in India’s Real Assets

Upcoming Webinar on Investments in UK Warehousing | 18th September at 11:00 AM BST | Register Now

India’s only PMS investing in listed REITs and InvITs

8-9%

Target Yield

12-15%

Target IRR

SEBI

Regulated

Alt REIT InvIT Portfolio Strategy (ARIPS) is a portfolio management scheme (PMS) that invests in units of listed real estate investment trusts (REITs) and infrastructure investment trusts (InvITs).

ARIPS is a yield strategy that targets 8-9% annual yield for investors plus capital appreciation of c. 4-6% targeting total returns of 12-15% annually. ARIPS is the only such PMS in the market today.

100% occupancy by a diversified underlying tenant portfolio comprising of Fortune 500 companies, MNCs and bluechip tenants including Aditya Birla Capital and Concentrix.

Current Income

8-9% pa yield,

distributed quarterly

Institutional Assets

Grade A infrastructure and real estate assets

SEBI Regulated

SEBI regulated framework with client level holdings

Liquidity

Listed securities

with T+1 settlement

Diversification

Low correlation of 0.22 with index (Nifty 50)

Low Volatility

33% lesser volatility vs

index (Nifty 50)

* As of February 28, 2025

REITs and InvITs have given higher yields as compared to G-Secs, FDs and Debt MFs, with total returns slightly lower than equities.

REITs and InvITs have provided consistent returns between equities and government securities.

ARIPS investors can expect to make an unlevered IRR of 12-15% over a 4 year hold period.

| Day 0 | Year 1 | Year 2 | Year 3 | Year 4 | Total | Comments | |

|---|---|---|---|---|---|---|---|

| Investment | (₹50,00,000) | - | - | - | - | (₹50,00,000) | • Minimum investment ₹50,00,000 |

| Dividend | - | 4,00,000 | 4,20,000 | 4,41,000 | 4,63,050 | 17,24,050 | • 8% yield growing at 5% p.a. |

| Sale Value | - | - | - | - | 64,82,700 | 64,82,700 | • 7.5% exit yield |

| Total | (₹50,00,000) | ₹4,00,000 | ₹4,20,000 | ₹4,41,000 | ₹69,45,750 | ₹32,06,750 | |

| Yield | - | 8.0% | 8.4% | 8.8% | 9.3% | • Average yield of 8.6% p.a. |

Even at a conservative exit yield at 7.5%, the investment will return projected IRR of 14.5%

| Exit Yield (%) | ||||||

|---|---|---|---|---|---|---|

| 6.5% | 7.0% | 7.5% | 8.5% | 8.5% | ||

| Dividend growth rate (%) | 0.0% | 12.8% | 11.0% | 9.4% | 8.0% | 6.7% |

| 2.5% | 15.4% | 13.6% | 12.0% | 10.5% | 9.1% | |

| 5.0% | 18.0% | 16.2% | 14.5% | 13.0% | 11.6% | |

| 7.5% | 20.7% | 18.8% | 17.1% | 15.5% | 14.1% | |

| 10.0% | 23.3% | 21.4% | 19.6% | 18.0% | 16.5% | |

Note: Above figures represent gross returns and are for purposes of illustration only and may vary from actual returns.

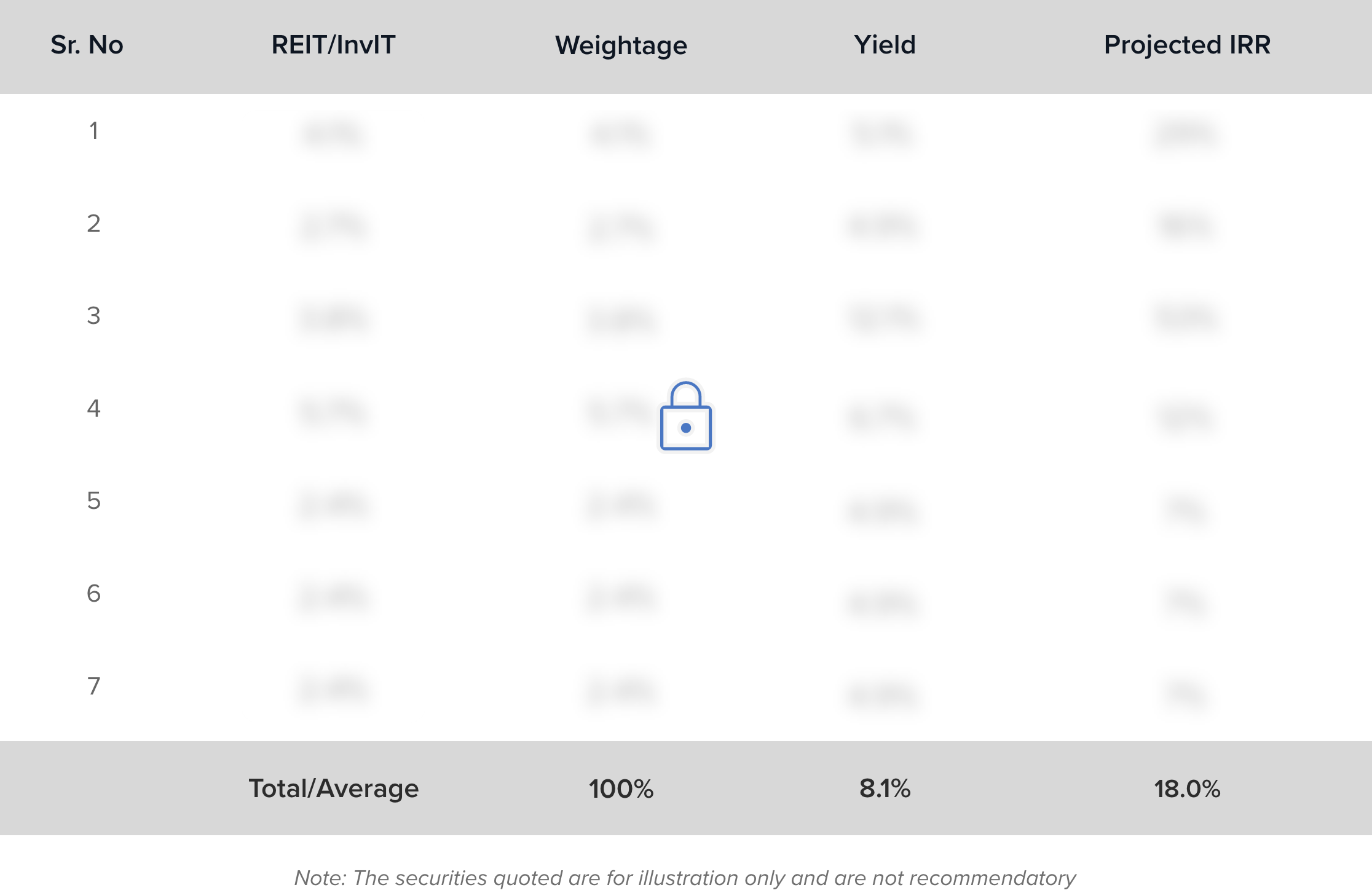

Alt's Investment team has identified 7 high quality REITs & InvITs which will provide high risk adjusted return

| Type | Discretionary Portfolio Management Scheme (DPMS) | |||

|---|---|---|---|---|

| Minimum Investment | ₹50 lakhs | |||

| Distributions | Quarterly | |||

| Asset Classes | Listed REITs/InvITs | |||

| Fees | 0.5 - 2.5 Cr | 2.5 - 5 Cr | > 5 Cr | |

| Annual Management Fee | 0.8% | 0.6% | 0.4% | |

| Performance Fee (on exit) over hurdle rate of 8% | 15% | 12.5% | 10% | |

| Exit Fee | Nil (after 2 years) | 1% (between 1–2 years) | 2% (less than 1 year) | |||

| Lock-in | Nil | |||

Alt Capital’s Investment Team comes with over 30 years of experience in real estate and public markets.

Rahul Jain

Managed $350 mn at Middle Eastern family office

B.Tech (IIT Bombay) and MBA (IIM Lucknow)

Alt’s advisory team comprises leaders with rich cross-border asset management and real estate experience.

C.B. Bhave is the former chairman of SEBI and NSDL. He is a 1975 batch IAS officer.

C.B. Bhave

Former Chairman,

SEBI

Alt Capital’s holding company is backed by venture investors including WestBridge, Lightspeed, Pravega and Beenext

Partner, WestBridge Capital

B. Tech (Electrical) from IIT Bombay and MBA from IIM Ahmedabad

Partner, Beenext

B.Sc. from Universität Hildesheim, MBA from Copenhagen Business School

Board Observer

Partner, Pravega Ventures

B. Tech (CS) from IIT Delhi and MS from University of North Carolina

Board Observer

Alt REIT InvIT Portfolio Strategy (ARIPS) is a portfolio management scheme that invests in units of listed real estate investment trusts (REITs) and infrastructure investment trusts (InvITs). ARIPS is a yield strategy that targets 8-9% annual yield for investors plus capital appreciation of c. 4-6% targeting total returns of 12-15% annually. ARIPS is the only such PMS in the market today.

A Portfolio Management Service (PMS) is a customized and professionally managed investment solution offered by SEBI-registered portfolio managers. It provides tailored investment strategies based on the client’s financial objectives and risk profile. Unlike mutual funds, a PMS account is maintained in the client’s individual name, offering greater transparency, control, and personalized asset allocation.

As per SEBI regulations, the minimum investment amount for any PMS is ₹50 lakhs.

Once onboarded, the PMS follows a structured investment process:

Step 1: Client onboarding with PMS agreement and KYC compliance

Step 2: Account setup with custodian and fund transfer

Step 3: Portfolio construction by the investment team, aligned to the strategy

Step 4: Ongoing monitoring, tactical rebalancing, and risk management

Step 5: Regular client reporting (portfolio performance, income distributions, tax documents)

There is no statutory lock-in period under PMS regulations. You may request partial or full liquidation of your portfolio at any time, subject to operational processing timelines and liquidity of underlying securities. However, we recommend a minimum investment horizon of 2–3 years to fully realize the strategy’s benefits.

Yes. We are a SEBI registered PMS license holder. Our license number is INP000006800.

Since PMS portfolios are managed in your individual capacity, taxation is applied on a pass-through basis. You are liable to pay tax on capital gains (short-term or long-term, depending on holding period) and on any interest/dividend income earned through your portfolio. Tax is not deducted at source (TDS) by the PMS. We provide detailed capital gains statements and income breakups for your tax filings. Please consult your tax advisor for personalized tax planning.

You can invest by signing the PMS agreement, completing KYC and onboarding, and transferring funds to your designated PMS account. Our team will guide you through the process and ensure full compliance with SEBI norms.

The following documents are typically required to invest in a PMS:

For Individual Investors:

-PAN card copy

- Aadhaar card copy (linked with mobile number for OTP-based KYC)

- Proof of address (passport, driving license, or utility bill)

- Bank account proof (cancelled cheque or bank statement)

- Demat account details (or consent to open one through PMS custodian)

- Recent passport-sized photograph

- Income proof (as per PMLA guidelines)

- FATCA/CRS declaration form

- PMS account opening form and signed agreement

For Non-Individual Investors (NRI, HUF, Company, Trust, etc.), additional entity-specific documents will be required, including board resolutions, registration certificates, and authorized signatory proofs.

All investments under the PMS are held in the client’s name through a dedicated demat and bank account opened specifically for the PMS relationship. These accounts are maintained with a SEBI-registered custodian and are fully compliant with regulatory norms.

The strategy targets a distribution yield of 8-9% annually, with a total return potential of 12–15% per annum over a full market cycle. Actual returns may vary based on market conditions, asset performance, and interest rate environment.

Target Yield

8-9%

Target IRR

12-15%

Asset Class

Listed REITs/InvITs

Liquidity

T+1

Min investment: ₹50 lakhs

Ben has 19+ years experience in real estate including as Director at First Alliance Properties , a UK based investment firm where he was instrumental in acquiring and managing a portfolio of £350m+. Ben is a member of the Royal Institute of Chartered Surveyors and holds an MSc in Property Investment & Management from Napier University Edinburgh and a BA Honors from University of Bristol.

Vikaash Khdloya was the CEO of India's first and Asia's largest office REIT by size, the Embassy Office Parks REIT. Prior to heading the Embassy REIT, Vikaash was MD at Blackstone India’s real estate office prior to which he was VP at Piramal Capital. Vikaash’s accolades also include being member of the Economic Times 40 Under 40 list, CNBC 40 Under 40 list, being a Global Young Presidents’ Organisation (YPO) member, an alumnus of Harvard Business School, a CA gold medallist and a CFA charter holder.

Former Chairman, SEBI

C.B. Bhave served as Chairman of the Securities and Exchange Board of India (SEBI) for a period of three years starting February 2008. He has also been the Chairman and Managing Director of the then newly created National Securities Depository Limited (NSDL). He is an electrical engineer from Jabalpur Engineering College and 1975 batch IAS officer.

Felix Kuna is the MD at K3 Capital, a German family office. Prior to this Felix was the Co-founder of Myo, a German communication platform for the care sector. Felix has worked across real estate sectors in Blackstone and Myo ranging from office, retail, warehousing and more recently the European care home sector. He holds an MBA from IESE Business School, Barcelona.

Enter your mobile number to continue

Please enter your email and we’ll send you a link to reset your password

Email and password login will soon be discontinued. You’ll need to login using your mobile number and OTP. Please update your mobile number in your account settings to ensure uninterrupted access.

Thank you for registering for our upcoming webinar on

We will send you a confirmation email with all the key details.

1:1 appointment confirmed

An appointment with our advisor has been scheduled on

Brief introduction (1-2 mins)

Brief introduction (1-2 mins)

Short video presentation on the product and strategy (2-8 mins)

Short video presentation on the product and strategy (2-8 mins)

Q&A (5 mins)

Q&A (5 mins)

You will shortly receive a confirmation email and text with all the key

details on your registered email address

and

mobile number .

Your call with our advisor has been canceled

Are you sure you want to cancel your call with our advisor scheduled on

You may reschedule the call, if needed.

Registration confirmed

You have registered for our next weekly CIO Private Briefing on

You will shortly receive a confirmation email and text with all the key details on your registered email address and mobile number .

Thank you for registering for our upcoming webinar on

We will send you a confirmation email with all the key details.

You have already registered for this webinar. We will again initiate a confirmation email with all the key details to your email address.