Profit from investing in Indian REITs, InvITs and SM REITs

8-15%

Rental yields

₹8.6 trillion

AUM

0.14

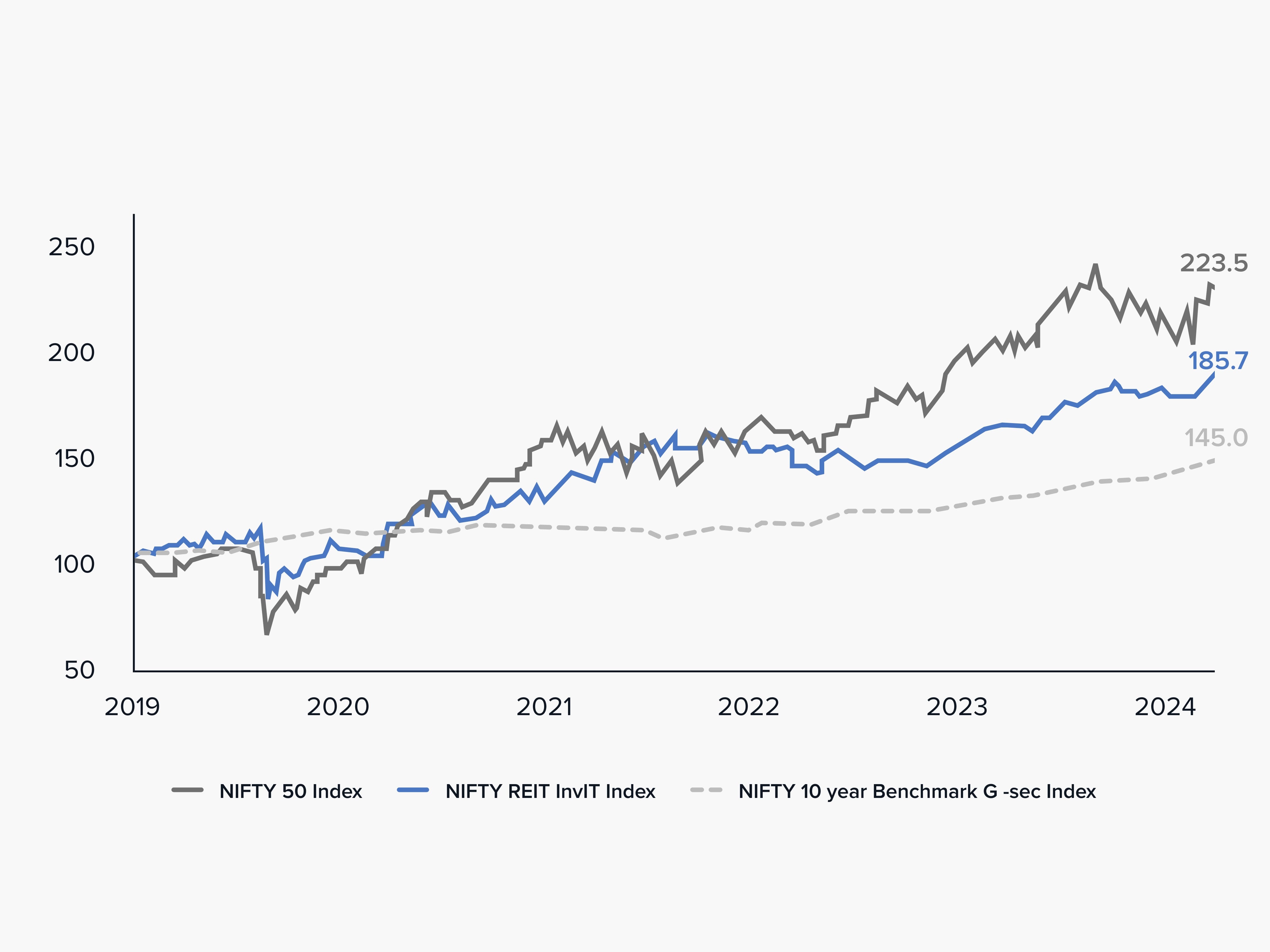

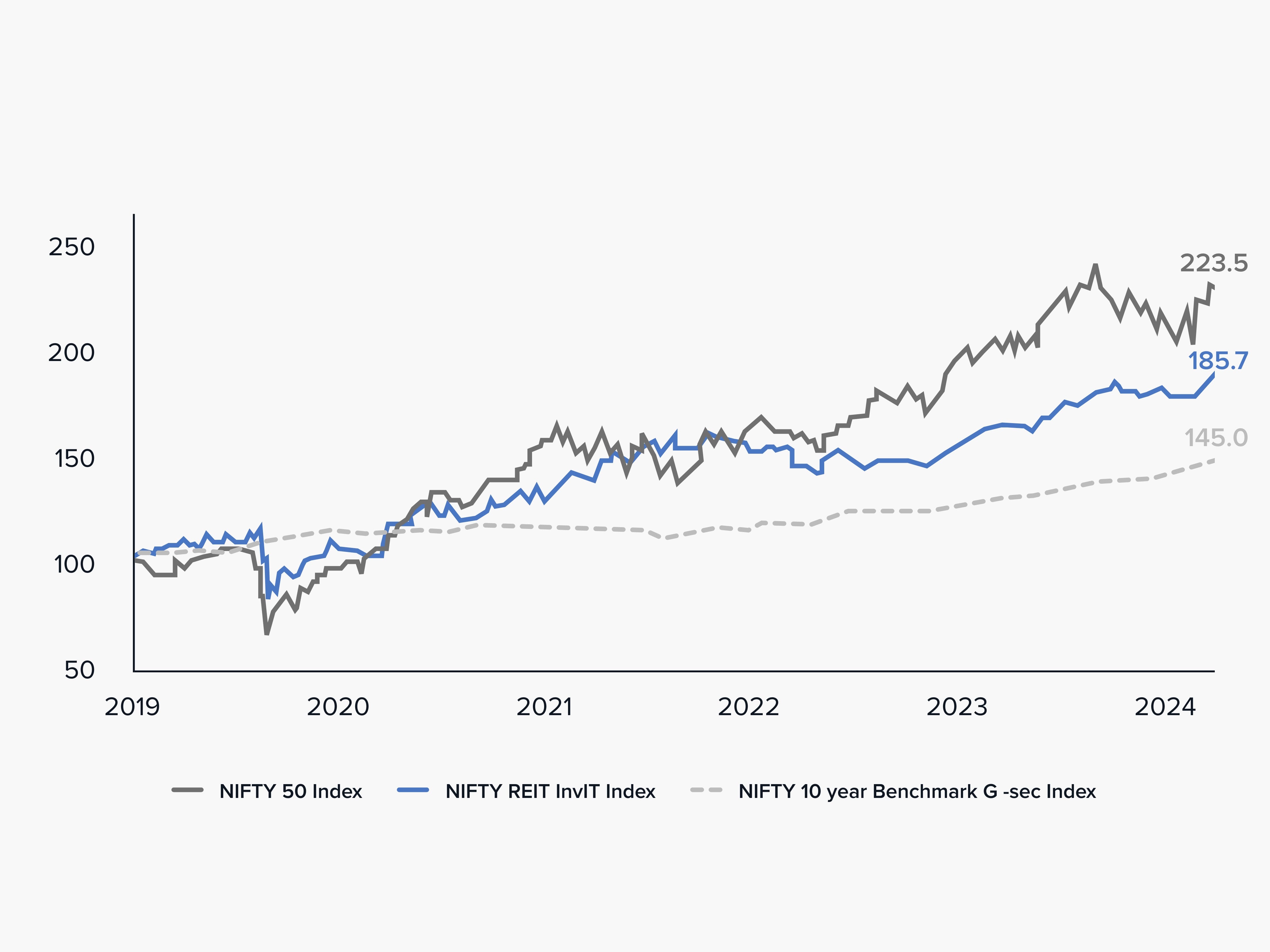

Low correlation to equity

markets (vs Nifty 50)

High Yield

Distributions between 8 - 10% per annum, paid out quarterly

Institutional Quality

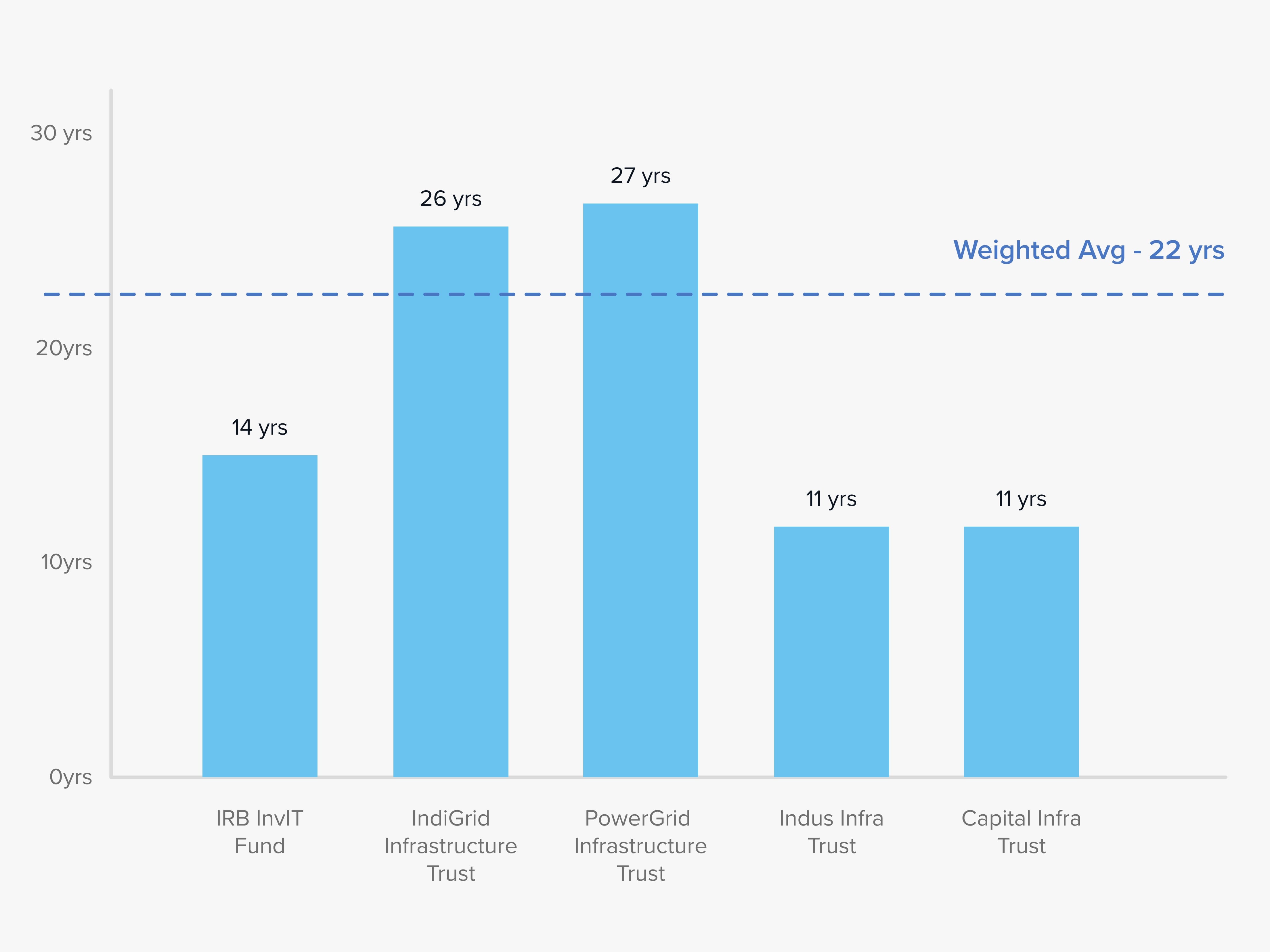

REITs, InvITs and SM REITs own Grade A real estate and infrastructure assets

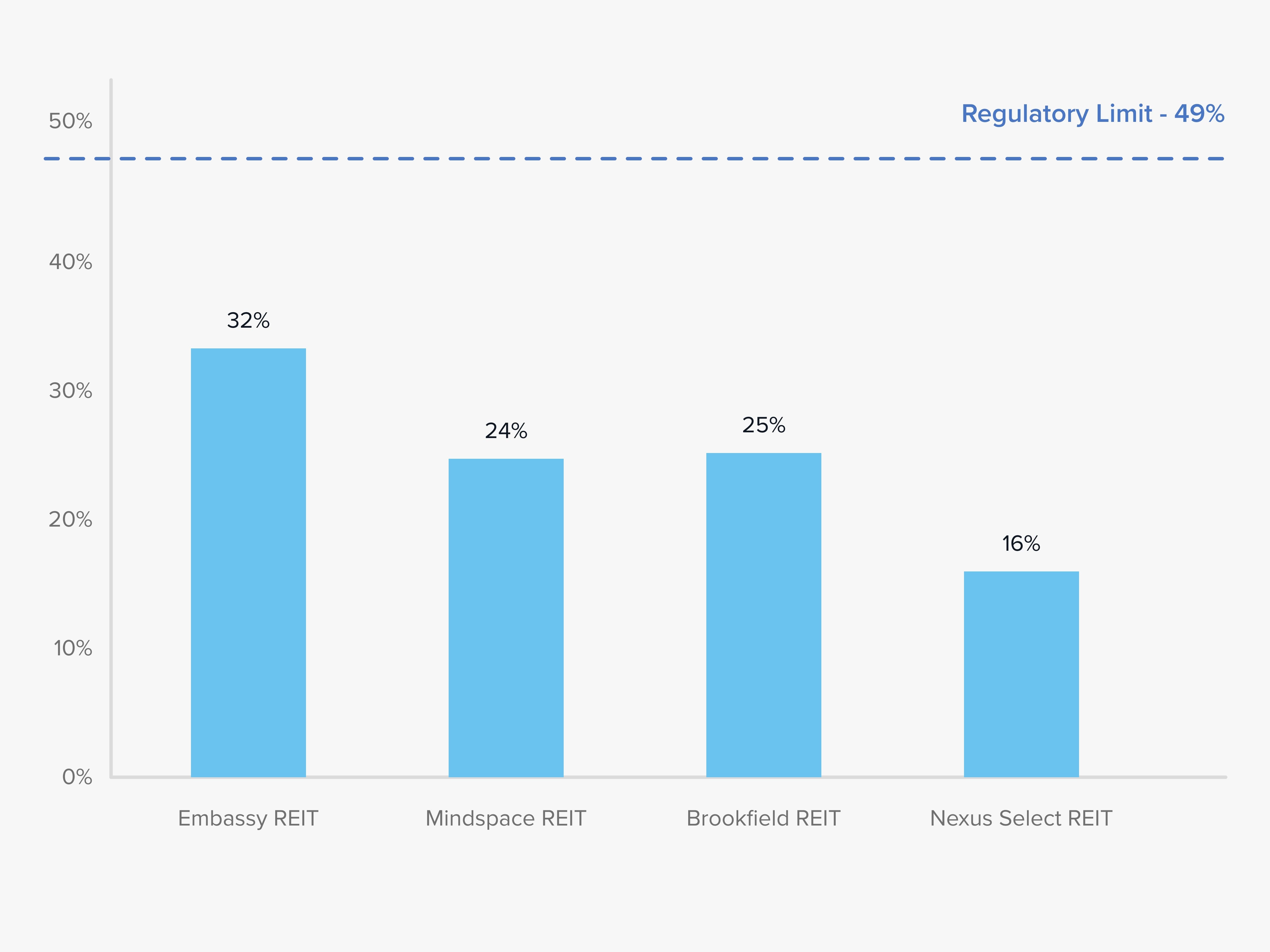

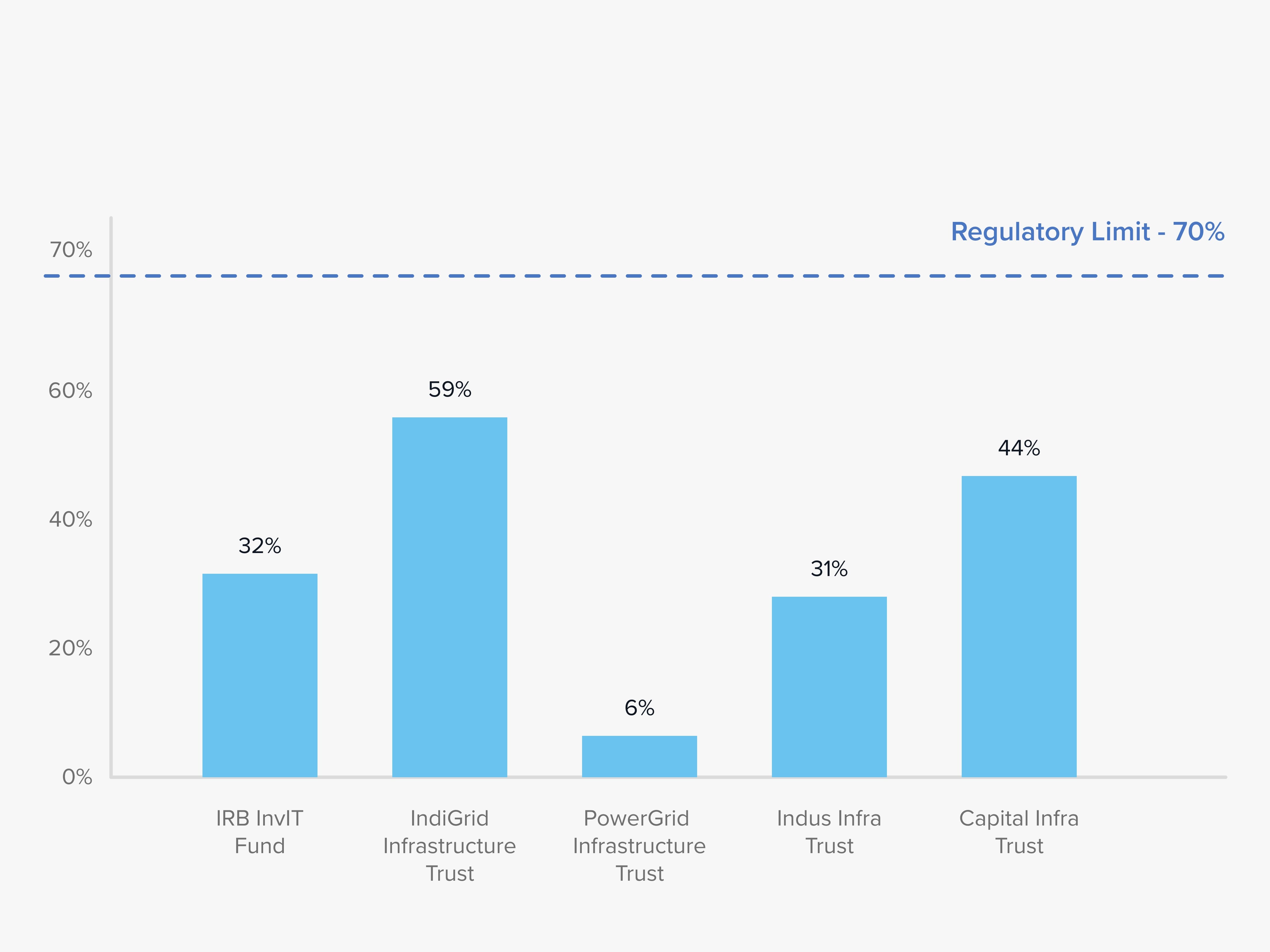

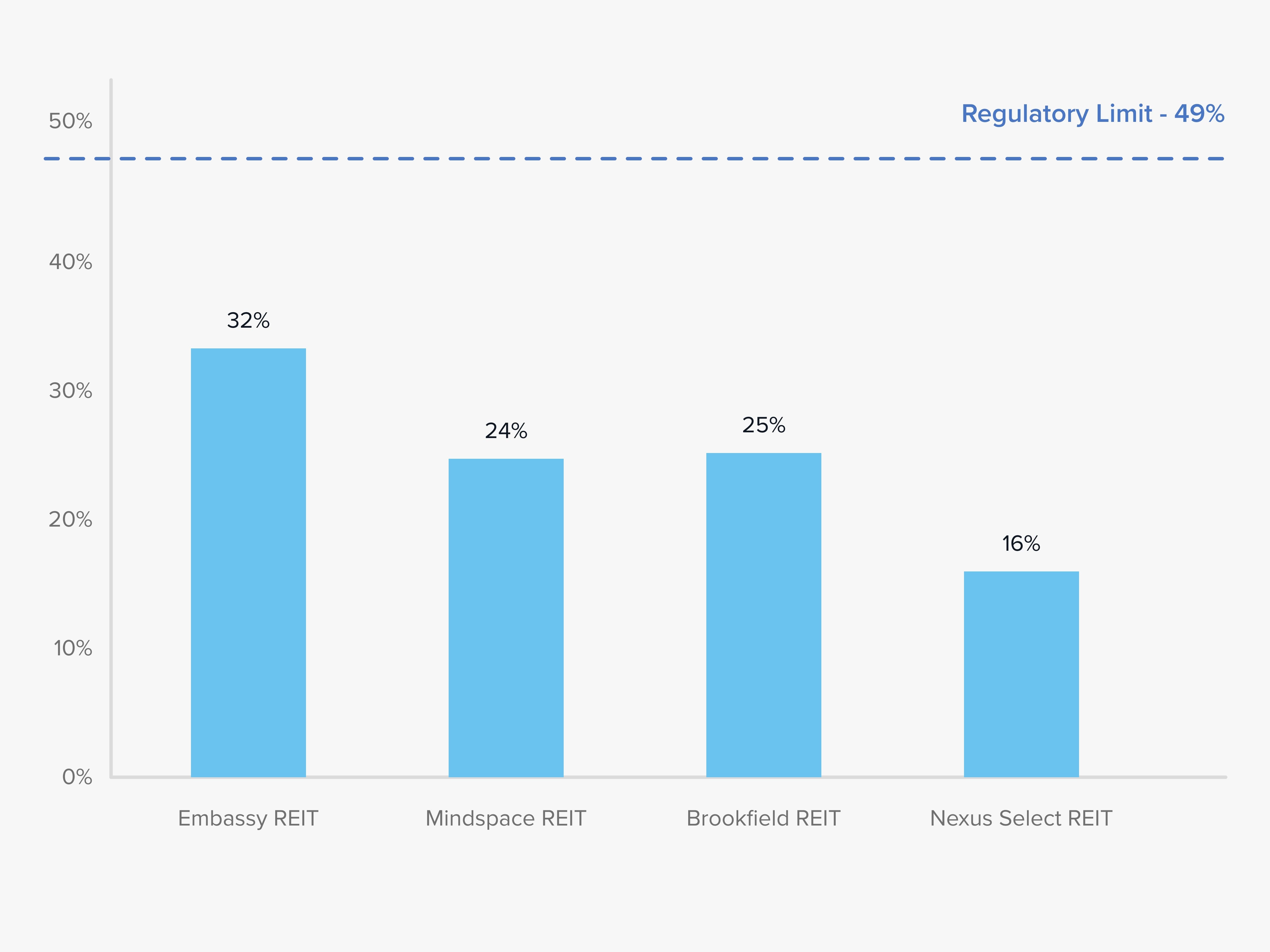

SEBI Regulated

Highly transparent, strong corporate governance and mandatory listing making it more liquid

Diversification

Invest across the country in offices, malls, toll road projects, and power transmission lines

The authors have over 30 years of experience investing in Indian real estate as well as global listed REITs.

Our advisory board comprises leaders with rich cross-border asset management and real estate experience.

Alt Capital's holding company is backed by venture investors including WestBridge, Lightspeed, Pravega and Beenext

Please enter your email and we’ll send you a link to reset your password

Former Chairman, SEBI

C.B. Bhave served as Chairman of the Securities and Exchange Board of India (SEBI) for a period of three years starting February 2008. He has also been the Chairman and Managing Director of the then newly created National Securities Depository Limited (NSDL). He is an electrical engineer from Jabalpur Engineering College and 1975 batch IAS officer.

Ben has 19+ years experience in real estate including as Director at First Alliance Properties , a UK based investment firm where he was instrumental in acquiring and managing a portfolio of £350m+. Ben is a member of the Royal Institute of Chartered Surveyors and holds an MSc in Property Investment & Management from Napier University Edinburgh and a BA Honors from University of Bristol.

default/desktop/why-propshare.advisory-board-bio-modal.modal-3.designation

default/desktop/why-propshare.advisory-board-bio-modal.modal-3.description

Vikaash Khdloya was the CEO of India's first and Asia's largest office REIT by size, the Embassy Office Parks REIT. Prior to heading the Embassy REIT, Vikaash was MD at Blackstone India’s real estate office prior to which he was VP at Piramal Capital. Vikaash’s accolades also include being member of the Economic Times 40 Under 40 list, CNBC 40 Under 40 list, being a Global Young Presidents’ Organisation (YPO) member, an alumnus of Harvard Business School, a CA gold medallist and a CFA charter holder.

Mamoru Taniya is Chairman of Asuka Holdings Inc. He joined Salomon Brothers in 1987, where he became the youngest Managing Director responsible for the regional trading division of Asia. He founded Asuka Asset Management, which was one of the first independent hedge finds in Japan in addition to the private equity fund Mercuria with DBJ. He also serves as Investment Committee member of East Ventures, Partner at D4V with IDEO, and Partner at Evolution in the U.S. He received his Bachelor of Arts degree in law from the University of Tokyo.

Felix Kuna is the MD at K3 Capital, a German family office. Prior to this Felix was the Co-founder of Myo, a German communication platform for the care sector. Felix has worked across real estate sectors in Blackstone and Myo ranging from office, retail, warehousing and more recently the European care home sector. He holds an MBA from IESE Business School, Barcelona.

Research Study

Access to the comprehensive report is restricted to users with an active login. Please sign in or sign up now to unlock the full content.